Our Financial Hardship Department will assess your individual situation and provide options. This may be short term and in some cases long periods of time dependent on your situation.

-

MODELS

-

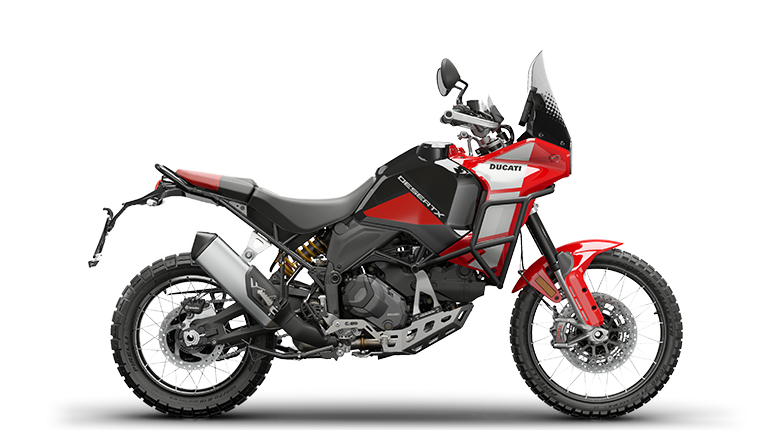

DesertX

![]()

- DesertX Family

-

new

DesertX Discovery

![]() DesertX Discovery

DesertX Discovery- 110 hp Power

- 92 Nm Torque

- 210 kg Wet Weight No Fuel

Suggested Ride Away Price From $29,800 AUD

Suggested Retail Price From $32,293 NZD i -

DesertX

![]() DesertX

DesertX- 110 hp Power

- 92 Nm Torque

- 210 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $27,300 AUD

Suggested Retail Price From $29,693 NZD

Per week cost available* i -

Rally

![]() DesertX Rally

DesertX Rally- 110 hp Power

- 92 Nm Torque

- 211 kg Wet Weight (No Fuel)

Suggested Ride Away Price from $38,100 AUD

Suggested Retail Price From $37,893 NZD i

DesertX -

Diavel

![]()

-

XDiavel

![]()

-

new

V4

![]() XDiavel V4

XDiavel V4- 168 hp Power

- 126 Nm Torque

- 229 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $46,500 AUD

Suggested Retail Price From $50,193 NZD i -

Dark

![]() XDiavel*Only for countries where Euro 5 standard applies

XDiavel*Only for countries where Euro 5 standard applies- 160 hp* Power

- 126 Nm Torque

- 233 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $33,300 AUD

Suggested Retail Price From $36,257 NZD

Per week cost available* i -

S

![]() XDiavel S* Only for countries where Euro 5 standard applies.

XDiavel S* Only for countries where Euro 5 standard applies.- 160 hp* Power

- 126 Nm Torque

- 235 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $40,600 AUD

Suggested Retail Price From $44,357 NZD i

XDiavel -

new

V4

-

Hypermotard

![]()

-

698 Mono

![]() Hypermotard 698 Mono

Hypermotard 698 Mono- 77.5 hp Power

- 63 Nm Torque

- 151 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $24,100 AUD

Suggested Retail Price From $25,163 NZD

Per week cost available* i -

698 Mono RVE

![]() Hypermotard 698 Mono RVE

Hypermotard 698 Mono RVE- 77.5 hp Power

- 63 Nm Torque

- 151 kg Wet Weight No Fuel

Suggested Ride Away Price From $25,400 AUD

Suggested Retail Price From $26,163 NZD i -

950 RVE

![]() Hypermotard 950 RVE

Hypermotard 950 RVE- 114 hp Power

- 96 Nm Torque

- 193 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $27,900 AUD

Suggested Retail Price From $30,363 NZD i -

950

![]() Hypermotard 950

Hypermotard 950- 114 hp Power

- 96 Nm Torque

- 193 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $26,000 AUD

Suggested Retail Price From $28,363 NZD i -

950 SP

![]() Hypermotard 950 SP

Hypermotard 950 SP- 114 hp Power

- 96 Nm Torque

- 191 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $31,900 AUD

Suggested Retail Price From $34,763 NZD i

Hypermotard -

698 Mono

-

Monster

![]()

-

Monster

![]() Monster

Monster- 111 hp Power

- 93 Nm Torque

- 179 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $19,900 AUD

Suggested Retail Price From $21,758 NZD

Per week cost available* i -

Monster +

![]() Monster +

Monster +- 111 hp Power

- 93 Nm Torque

- 179 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $20,500 AUD

Suggested Retail Price From $22,458 NZD i -

Monster SP

![]() Monster SP

Monster SP- 111 hp Power

- 93 Nm Torque

- 177 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $23,400 AUD

Suggested Retail Price From $26,258 NZD i -

new

Monster Senna

![]() Monster Senna

Monster Senna- 111 hp Power

- 93 Nm Torque

- 175 kg Wet Weight No Fuel

Suggested Ride Away Price From $42,500 AUD

Suggested Retail Price From $44,563 NZD i

Monster -

Monster

-

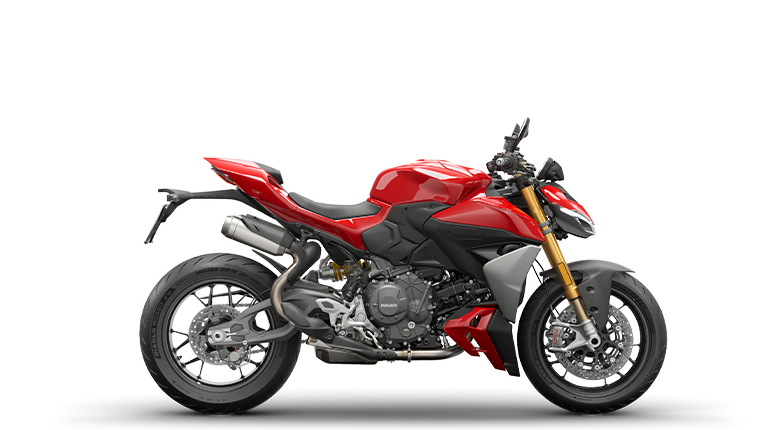

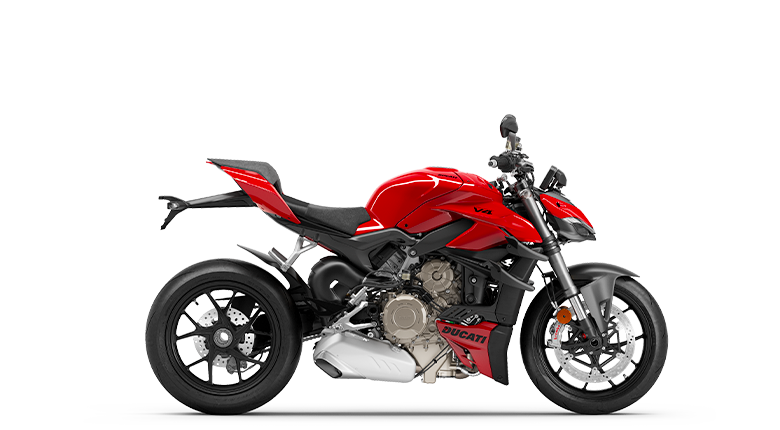

Streetfighter

![]()

-

new

V2

![]() Streetfighter V2

Streetfighter V2- 120 hp Power

- 93.3 Nm Torque

- 178 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $22,400 AUD

Suggested Retail Price From $22,693 NZD

Per week cost available* i -

V2 2024

![]() Streetfighter V2 2024

Streetfighter V2 2024- 153 hp Power

- 101,4 Nm Torque

- 193 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $24,900 AUD

Suggested Retail Price From $27,067 NZD i -

new

V2 S

![]() Streetfighter V2 S

Streetfighter V2 S- 120 hp Power

- 93.3 Nm Torque

- 175 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $24,700 AUD

Suggested Retail Price From $25,093 NZD i -

new

V4

![]() Streetfighter V4

Streetfighter V4- 214 hp Power

- 120 Nm Torque

- 191 kg Wet Weight No Fuel

Suggested Ride Away Price From $38,400 AUD

Suggested Retail Price From $41,693 NZD i -

V4 2024

![]() Streetfighter V4 2024

Streetfighter V4 2024- 208 hp Power

- 123 Nm Torque

- 195 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $35,800 AUD

Suggested Retail Price From $39,067 NZD i -

new

V4 S

![]() Streetfighter V4 S

Streetfighter V4 S- 214 hp Power

- 120 Nm Torque

- 189 kg Wet Weight No Fuel

Suggested Ride Away Price From $43,100 AUD

Suggested Retail Price From $46,893 NZD i -

V4 S 2024

![]() Streetfighter V4 S 2024

Streetfighter V4 S 2024- 208 hp Power

- 123 Nm Torque

- 195 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $40,200 AUD

Suggested Retail Price From $43,972 NZD i -

V4 SP2

![]() Streetfighter V4 SP2

Streetfighter V4 SP2- 208 hp Power

- 123 Nm Torque

- 177 kg Dry Weight

Suggested Ride Away Price From $51,900 AUD

Suggested Retail Price From $57,193 NZD i -

new

V4 Supreme®

![]() Ducati Streetfighter V4 Supreme®

Ducati Streetfighter V4 Supreme®- 208 hp Power

- 123 Nm Torque

- 193 kg Wet Weight No Fuel

Suggested Ride Away Price From $67,200 AUD

Suggested Retail Price From $75,793 NZD i

Streetfighter -

new

V2

-

Multistrada

![]()

- OVERVIEW

-

new

V2

![]() Multistrada V2

Multistrada V2- 115,6 hp Power

- 92,1 Nm Torque

- 199 kg Wet Weight No Fuel

Suggested Ride Away Price From $26,100 AUD

Suggested Retail Price From $28,093 NZD i -

V2 2024

![]() Multistrada V2 2024

Multistrada V2 2024- 113 hp Power

- 96 Nm Torque

- 217 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $24,600 AUD

Suggested Retail Price From $26,572 NZD

Per week cost available* i -

new

V2 S

![]() Multistrada V2 S

Multistrada V2 S- 115,6 hp Power

- 92,1 Nm Torque

- 202 kg Wet Weight No Fuel

Suggested Ride Away Price From $29,200 AUD

Suggested Retail Price From $30,793 NZD i -

V2 S 2024

![]() Multistrada V2 S 2024

Multistrada V2 S 2024- 113 hp Power

- 96 Nm Torque

- 220 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $27,400 AUD

Suggested Retail Price From $29,972 NZD i -

new

V4

![]() Multistrada V4

Multistrada V4- 170 hp Power

- 124 Nm Torque

- 229 kg Wet Weight No Fuel

Suggested Ride Away Price From $32,700 AUD

Suggested Retail Price From $35,893 NZD i -

V4 2024

![]() Multistrada V4 2024

Multistrada V4 2024- 170 hp Power

- 125 Nm Torque

- 228 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $31,500 AUD

Suggested Retail Price From $34,267 NZD i -

new

V4 S

![]() Mulltistrada V4 S

Mulltistrada V4 S- 170 hp Power

- 124 Nm Torque

- 231 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $37,900 AUD

Suggested Retail Price From $41,893 NZD i -

V4 S 2024

![]() Multistrada V4 S 2024

Multistrada V4 S 2024- 170 hp Power

- 125 Nm Torque

- 231 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $36,600 AUD

Suggested Retail Price From $39,867 NZD i -

V4 Rally

![]() Multistrada V4 Rally

Multistrada V4 Rally- 170 hp Power

- 121 Nm Torque

- 238 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $42,600 AUD

Suggested Retail Price From $47,193 NZD i -

new

V4 Pikes Peak

![]() Multistrada V4 Pikes Peak

Multistrada V4 Pikes Peak- 170 hp Power

- 124 Nm Torque

- 227 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $48,800 AUD

Suggested Retail Price From $54,093 NZD i -

V4 Pikes Peak 2024

![]() Multistrada V4 Pikes Peak 2024

Multistrada V4 Pikes Peak 2024- 170 hp Power

- 125 Nm Torque

- 227 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $47,100 AUD

Suggested Retail Price From $51,567 NZD i - V4 RS

Multistrada -

Panigale

![]()

- OVERVIEW

-

new

V2

![]() V2

V2- 120 hp Power

- 93.3 Nm Torque

- 179 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $24,500 AUD

Suggested Retail Price From $24,593 NZD

Per week cost available* i -

V2 2024

![]() Panigale V2 2024

Panigale V2 2024- 155 hp Power

- 104 Nm Torque

- 193 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $27,000 AUD

Suggested Retail Price From $29,272 NZD i -

new

V2 S

![]() Panigale V2 S

Panigale V2 S- 120 hp Power

- 93.3 Nm Torque

- 176 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $26,800 AUD

Suggested Retail Price From $26,993 NZD i -

new

V2 Superquadro Final Edition

![]() V2 Superquadro Final Edition

V2 Superquadro Final Edition- 155 hp Power

- 104 Nm Torque

- 190 kg Wet Weight No Fuel

Suggested Ride Away Price From $38,300 AUD

Suggested Retail Price From $33,493 NZD i -

V2 Bayliss

![]() Panigale V2 Bayliss 1st Champion 20th Anniversary

Panigale V2 Bayliss 1st Champion 20th Anniversary- 155 hp Power

- 104 Nm Torque

- 190 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $30,400 AUD

Suggested Retail Price From $41,793 NZD i -

new

V4

![]() V4

V4- 216 hp Power

- 120.9 Nm Torque

- 191 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $38,800 AUD

Suggested Retail Price From $42,072 NZD i -

V4 2024

![]() V4 2024

V4 2024- 215.5 hp Power

- 123.6 Nm Torque

- 192 kg Wet Weight No Fuel

Suggested Ride Away Price From $36,300 AUD

Suggested Retail Price From $39,572 NZD i -

new

V4 S

![]() V4 S

V4 S- 216 hp Power

- 120.9 Nm Torque

- 187 kg Wet Weight (No Fuel)

Suggested Ride Away Price From $49,300 AUD

Suggested Retail Price From $53,672 NZD i -

V4 S 2024

![]() V4 S 2024

V4 S 2024- 215.5 hp Power

- 123.6 Nm Torque

- 189 kg Wet Weight No Fuel

Suggested Ride Away Price From $46,000 AUD

Suggested Retail Price From $50,472 NZD i -

V4 R

![]() Panigale V4 R

Panigale V4 R- 237 hp Racing setup Power

- 111.3 Nm Racing setup Torque

- 184 kg Racing setup Wet Weight (No Fuel)

Suggested Ride Away Price From $70,500 AUD

Suggested Retail Price From $77,793 NZD i -

V4 SP2

![]() Panigale V4 SP2

Panigale V4 SP2- 215.5 hp Power

- 123.6 Nm Torque

- 173 kg Dry Weight

Suggested Ride Away Price Price From $57,100 AUD

Suggested Retail Price From $62,878 NZD i -

new

V4 Tricolore

![]() Panigale V4 Tricolore

Panigale V4 Tricolore- 216 hp Power

- 120.9 Nm Torque

- 188 kg Wet weight no fuel

Suggested Ride Away Price From $84,700 AUD

Suggested Retail Price From $85,793 NZD i -

new

V4 Tricolore Italia

![]() Panigale V4 Tricolore Italia

Panigale V4 Tricolore Italia- 216 hp Power

- 120.9 Nm Torque

- 188 kg Wet Weight No Fuel

Suggested Ride Away Price From $126,000 AUD

Suggested Retail Price From $131,793 NZD i -

new

V4 Lamborghini

![]() Panigale V4 Lamborghini

Panigale V4 Lamborghini- 218.5 hp Power

- 122.1 Nm Torque

- 185 kg Wet Weight No Fuel

Suggested Ride Away Price From $105,300 AUD

Suggested Retail Price From $115,793 NZD i

Panigale -

![]()

-

Off-Road

![]()

-

new

Desmo450 MX

![]() Desmo450 MX

Desmo450 MX- 63,5 hp Power

- 53,5 Nm Torque

- 104,8 kg Wet Weight No Fuel

Suggested Ride Away Price From $16,300 AUD

Suggested Retail Price From $17,793 NZD i

Off-Road -

new

Desmo450 MX

-

Limited Series

![]()

- Ducati Speciale

- Ducati Unica

Limited Series

-

- Weekly Repayment

- Pre-Owned

- DWP 2026

- Current Offers

- Events

- Press Reviews

- Ducati Academy Australia

- Travel Adventures Australia

- Ducati Academy Europe

- Travel Adventures Europe

- Ducati Stories

- News

- MotoGP

- Superbike

- Ducati Australia Racing

- Motocross

- MotoE

Desmo Sport Ducati Racing

Keep up to speed with Desmo Sport Ducati Racing in the Australian Superbike Championship!

DesmoSport Ducati- Services

- Maintenance

- Connectivity

- Dealer network

- Who we are

- Innovation

- Design

- CORPORATE SOCIAL RESPONSIBILITY

- Partners

- FONDAZIONE DUCATI

- Borgo Panigale Experience

Financial Assistance

We understand that life can take unexpected turns due to unforeseen circumstances. We are committed to assisting you with finding a suitable solution to manage your repayments, whilst you get back on your feet. Please contact us if you are experiencing Financial Hardship.

What is Financial Hardship?

Financial Hardship is when a customer is willing and has the intention to pay, but due to a change in their circumstances, is now unable to meet their repayments or existing financial obligations. With formal hardship assistance, their financial situation will be restored.

Reasons which may qualify you for Financial Hardship

- Common events contributing to financial difficulty may include:

- Changes in income and/or expenses

- Changes in employment such as reduced hours, loss of job, reduced pay

- Significant life events such as illness, injury, relationship break down, death or disability

- Natural disaster

- Legal matters such as court actions, judgement or court orders

- Company failure or some other event such as insolvency or administration

- How long is the assistance period?

-

- What kind of support documents do I need?

-

Each situation is assessed on its own merits. You may need to provide further information such as proof of income, liabilities, expenditure and anything that is applicable to your circumstances.

- How long will it take to receive a response?

-

We are required to provide you with an outcome or next steps within 21 days of you submitting your application. However, in most cases you will receive a response sooner.

- Will I still be contacted by the Collections Department whilst assistance is in place?

-

No, there will be no collections activity during this period as long as you comply with your hardship arrangement.

- What happens if Ducati Financial Services does not support my request for Financial Hardship?

-

We will advise you in writing of the reason. You may wish to seek further financial advice from a financial advisor or a third party in regards to the alternate options that may be available to you.

- What happens if I am not satisfied with the outcome?

-

If you are unsatisfied with our response, you can contact our Financial Hardship Department on 1300 734 567 (Option 1) to discuss our decision. If your concern is still not resolved, you may lodge a complaint via our internal disputes resolutions scheme by emailing feedback@vwfs.com.au

If you do not agree with our decision or suggested resolution, you may refer your complaint to the Australian Financial Complaints Authority (AFCA), an external dispute resolution scheme of which we are a member.

Mail: Australian Financial Complaints Authority, GPO Box 3 Melbourne VIC 3001

Phone: 1800 931 678 (free call)

Email: info@afca.org.au

Website: www.afca.org.au

In order to assess your eligibility for financial hardship assistance, we require you to apply online via our Financial Assistance Portal (supported web browsers include Google Chrome, Firefox and Microsoft Edge).

Apply for Financial Hardship Assistance > [URL: https://assist.vwfsaustralia.com.au/newapplication/capture_1)

If you have any questions and would like to speak to one of our Financial Assistance representatives, please call or email us.

Phone:

1300 734 567

Mon – Fri 9:00am – 5:00pm (AEST)

If you are overseas, please call:

+61 2 9695 6311 (Select Option 1)

Email:

Once you have lodged your Financial Hardship Assistance application, your circumstances will be assessed to see what arrangements or options may be suitable for you. We will notify you of the outcome within 21 days.

Should we require additional information, one of our Financial Assistance representatives will be in contact with you to discuss the matter further.

Important Forms

Ducati Financial Services FAQ’s

- What products do you offer?

-

i. Consumer Loan

With 100% finance for approved customers, there’s nothing to pay upfront. You have options to personalise your loan by choosing the contract term length or paying a deposit amount of your choice and/or tailoring your repayments to suit your needs. A competitive fixed interest rate means you can budget with confidence. When your last payment is made, your new Ducati is completely yours.

All Consumer Loans are subject to eligibility criteria and Ducati Financial Services credit lending criteria.

ii. Chattel Mortgage

A Chattel Mortgage (Business/Commercial loan) might be the right option for you if your Ducati is for business purposes. You can take ownership of your Ducati from day one. We take a mortgage over the vehicle as security while you pay back your loan. This can be an affordable way to finance a vehicle for business use and gives you ownership of your Ducati. You can tailor your Chattel Mortgage to your business needs.

All Chattel Mortgages are subject to eligibility criteria and Ducati Financial Services credit lending criteria.

- How much can I borrow?

-

Eligible customers can borrow up to 100% of the cost of their vehicle, including all on-road costs, accessories/apparel and even registration. Of course, the amount you can borrow depends upon your personal situation and the type of finance you want to arrange. Your Business Manager can help you work out exactly how much you can borrow when you visit your Ducati dealership.

- Are deposits mandatory?

-

No, unless specified on a Ducati offer, you are free to set your own deposit. A higher deposit paid upfront will reduce your weekly, fortnightly or monthly repayment, so you can choose what works for you.

- What information do I need to provide to apply for a new vehicle finance contract?

-

We’ll do everything we can to help you take home your new Ducati as soon as possible - but to do that, we need some information from you, such as:

- Why you’re buying a motorcycle - is it for business or personal use?

- Your current driver's licence number and its expiry date.

- How much you earn. Make sure you bring recent pay slips with you, or if you’re self-employed, your last annual financial statements and tax returns.

- Information about your assets, savings and investments.

- Your monthly income, before tax, and your monthly living expenses.

- Information about other loans or finance you have, such as home loans, personal loans, credit cards and store accounts.

- How much you owe on each of your loans or credit facilities

- Your residential address and place of work for the past three years.

Your Business Manager may also ask you for other personal information, depending on your situation.

- How do I know which finance product to choose?

-

This will depend on your circumstances and what you want to achieve with both your vehicle and your finance package. A Ducati Financial Services Business Manager will be able to walk you through your options in the dealership. You should also ask your accountant or seek independent advice about which finance solution would suit your requirements.

- Where can I get Ducati Financial Services?

-

Use our ‘Find a dealer’ tool to find Ducati dealerships near you. Our Preferred Dealers all have Ducati Financial Services specialists ready to help you find the best package possible.

- Can I apply for finance if I am in Australia on a visa?

-

This will depend on your individual circumstances and the type of visa you have. You should talk to the Business Manager at your local dealership for more specific advice.

- Are your interest rates fixed or variable?

-

Our interest rates are fixed for the life of your contract term. So they’re easy to budget for, with no unexpected rate rises.

- How can I provide feedback?

-

We’re always looking for ways to improve our service, so we welcome any feedback you have. The easiest way to get in touch is to email customerservice@vwfs.com.au

- Is there a time limit on providing a complaint?

-

In most cases the sooner you inform us of a problem, the easier it will be to resolve. But generally, there is no time limit for telling us about your concerns.

- Will the information I provide be kept confidential?

-

Yes. It is covered by the same confidentiality and privacy rules as the finance we provide you.

- Can someone else make a complaint on my behalf?

-

Yes. However, you will need to give us your written consent that you give authorisation to another person to pursue the complaint. This is so we do not breach your privacy when we discuss your complaint with them.

Existing Customers

- Can I access my account online?

-

You can manage your vehicle finance using our online finance platform – myFinance Portal. It only takes a few minutes to sign up. Once you’ve registered, login using your email address as your username.

- What can I do on myFinance Portal?

-

Enjoy the flexibility of managing your vehicle finance, from one convenient place online. Some of the features you can expect to see:

- Keep track of your repayments and loan balance

- View your vehicle and loan details

- Change your direct debit details

- Download statements

- Update your personal contact details

- Request a copy of your contract

- How do I make extra repayments towards my loan?

-

You can make extra repayments through online transfer, BPAY or branch deposit. Please be advised a $4.50 non-direct debit fee is payable for the above options. To be provided with the transfer or BPAY details please send us an enquiry or email customerservice@vwfs.com.au

- Can I sell my motorbike whilst it is under finance?

-

Ducati Financial Services holds security over all vehicles financed with us. You may negotiate with a purchaser to sell your motorbike, however you are obligated to pay your loan in full upon the sale of your financed vehicle.

You can obtain a final payout quote and details on how to pay by submitting an online enquiry, emailing customerservice@vwfs.com.au or phoning 1300 734 567. We are unable to confirm this amount to the purchaser due to privacy, so simply pass them a copy of the Payout letter that you can request from our office.

- Once my loan is finalised, when is the Financial interest/PPSR (Personal Properties Securities Register) removed?

-

The PPSR/Financial interest will be removed exactly 7 days after we receive the full payout amount to finalise your loan. This is to allow time for the payment to clear.

- Can I change my payment amount?

-

Provided your payments are not less than the minimum monthly repayment, you can change the amount. You can also choose to make your payments weekly or fortnightly. Please submit an online enquiry or email customerservice@vwfs.com.au and we will be happy to help you update your payment amount.

- Can I change my payment frequency?

-

At Volkswagen Financial Services Australia, we have customers who make their payments on a weekly, fortnightly and monthly basis. You can request to change your payment frequency by contacting our customer service team who can assist you. You can also request to have a different direct debit payment date. Again, our customer service team can give you more information and assist you with these options.

- How can I obtain a copy of my loan statement?

-

To receive a copy of your loan statement you can login into the myFinance portal here or please submit an online enquiry or email customerservice@vwfs.com.au and we will be happy to arrange a statement for you. Please allow 1-2 business days to receive the requested statement.

- Can I arrange my statement to be sent to me automatically?

-

Unfortunately statements are not sent automatically. Every customer is entitled to one statement free of charge every 12 months upon request. Any additional statement within a 12 month period does incur a $20 document fee as outlined in your loan contract.

- How do I change the account my payments are debited from?

-

To amend the banking details which your payments are debited from, you can change your direct debit details via the myFinance portal here.

- Can I transfer my finance to another person?

-

Ducati Financial Services are unable to offer a transfer of finance. If you are considering changing the vehicles ownership to another party, the loan will need to be paid out in full. If you would like to obtain a payout figure and information on how to pay, please submit an online enquiry or email customerservice@vwfs.com.au and we will be happy to provide you with this information.

Ducati Financial Services Pty Limited ABN 20 097 071 460, Australian Credit Licence 389344.

View the Target Market Determination for our Financial Services products here

Australia

Australia

DesertX

DesertX Diavel

Diavel

XDiavel

XDiavel Hypermotard

Hypermotard

Monster

Monster Streetfighter

Streetfighter Multistrada

Multistrada Panigale

Panigale

Off-Road

Off-Road Limited Series

Limited Series